Australia needs more cash!

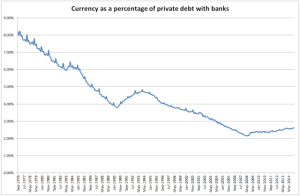

One of the major changes that has occurred over the past 20 to 30 years, since the days of financial deregulation, is the decline in the percentage of cash (liquid of currency) to bank assets (private debt). See graph 11.1 below:

Chart 11.1

This is significant because a ratio of this nature represents our nations ultimate ability to pay off the debt. In other words, the private sector using a bigger credit card to finance the existing credit card debt. The credit card being an analogy as most of this debt is these actual loans that are collateralise with assets. Albeit, there is an argument for these loans being under-collateralised on the back of overvalued asset prices, but lets not go there for now.

Over time the common trend is that when interest rates are decreased (through the cash rate), currency volumes need to increase to reduce the value of money into the future. Similarly, when interest rates are increased, currency volumes need to decrease to increase the value of money into the future. In order to balance the ratio of cash to private debt, interest rates will need to come down further, in conjunction with some form of quantitative easing (increasing the currency supply and circulating this currency through buying government bonds from the banks).

An argument for a sustainable rise to the cash rate in the near future has little merit given this long term trend.