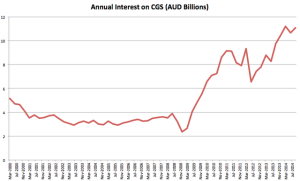

Who is paying the additional interest on the debt?

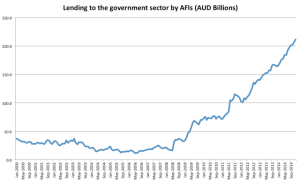

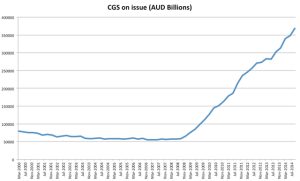

Much has changed in the world since the Financial Crisis of September 2008. Structural changes to financial markets have been a necessary evolution from this broadly unforeseen event. One of the major structural changes here in Australia has been the issuance of Commonwealth Government Securities (CGS) that has grown over 6 fold since September 2008; Australian Financial Intermediaries(AFIs) being are the largest domestic buyers of these instruments. The main reason for this is to ensure that in the event of a future financial crisis here in Australia the RBA would be able to inject liquidity into to AFIs quickly by printing currency and buying these holdings of bonds from the AFIs in a process known as Quantitative Easing (QE). This precautionary measure places the Australian banking system in much better position to weather a financial storm, but does come at a price. Chart 3.1 shows the change in the holdings of CGS and local and semi-government and other public authority securities by AFIs since January 2000.

One Response

Good afternoon. Many thanks 🙂 Excellent article.