Chart 10.1

The ABC News quoted ASIC last week saying:

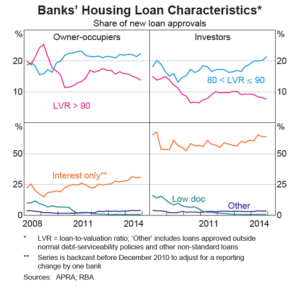

‘Interest-only loans offer a period, typically up to five years, where the borrower only has to pay the interest on the loan, rather than also paying down the principal.

This makes repayments lower in the short-term, but higher over the life of the loan.

‘The ASIC review of 140 individual loans found that in more than 30 per cent of cases there was no evidence the lender had considered whether the applicant could afford their repayments over the long term.

ASIC said in 20 per cent of cases the lenders had not considered the actual living expenses of applicants and in 40 per cent of files they had incorrectly calculated the affordability of the loan.’

Click here to reference the article.

‘”ASIC found that most lenders did not appear to be making sufficient inquiries in relation to requirements and objectives or, if they were, lenders were not recording their findings.”‘

King & Wood Mallesons law firm said;

‘”ASIC comments that in the context of an interest-only loan recording the objective or requirement of a borrower is ‘to purchase property’ is insufficient because it does not address why an interest-only loan as opposed to a principal and interest loan would better meet the borrower’s objectives… Without ASIC providing guidance on what is appropriate for each type of credit product it is hard to know what will satisfy the obligation.”‘

One Response

Good evening. Excellent article.